Economic Supply Chain Resilience: Just in Case/On Shore V Just InTime/Far shore. Five Porters Value Chain View

The Te Aoutanga Aotearoa Southern Link has been designed to articulate the value proposition into a physical eCommerce Logistics and Supply chain service that clearly identifies the costs and benefits of greater collaboration between China/Asia, Europe/North America, Australia New Zealand, and South America.

Including foreign investment, trade and innovation within a digitally enabled Special Economic Zone ecosystem.

Thus, empowering Economic Supply Chain Resilience."

5 Porters Value Chain

The economic value is symbiont (Business development/Added Value) to the Supply Chain and its critical support activities, we can use 5 Porters Value Chain to eloquent the interactive dynamics of Economic and Supply Chain within a unified Resilience.

This will be broken down into three core categories identifying:

1) Business development added Value relating to Economic Value.

2) Primary activities - physical supply chain.

3) Support activities.

1) Business development, Added Value relating to Economic Value:

1.1. Economic Value Added

- Development export coalitions with NZTE and business manufacturing associations.

- Development eCommerce technology including Blockchain business services.

- Opportunity for Pacific Island nations to access e-commerce world.

- Increase in employment.

- Hive for innovation including cloud and blockchain.

- Increase in foreign investment.

- Increase in revenue generation.

- Job creation in technology and export expertise.

- Conduit for Māori Business.

- Supply Chain Resilience

- Investment in infrastructure that has climate change mitigation at its forefront.

- Chinese eCommerce Market Place -Alibaba.

- South American eCommerce Market Place.

1.2. Australia Market place:

- Australia is the eleventh largest ecommerce market in the world, and revenue is predicted to reach USD25.7 billion in 2020 and USD32.3 billion by 2024. This represents a year-on-year increase of 15.5 percent. In comparison, the bricks and mortar retail market grew by 3.4% over the same period to reach USD200 billion.

- Online commerce represents approximately nine percent of all retail trade in the Australian market. The largest Australian eCommerce platforms/sites are eBay (AU) (69 million monthly visits), Amazon (AU) (22.5 million), Woolworths (20.4 million), JB Hi-Fi ((13.3 million), Big W (11.9 million), Coles (10.7 million), Kogan (10.2 million), Officeworks (9.45 million), Chemist Warehouse (9.1 million), and Catch (8.95 million).

- Australian business will utilise Southern Link accessibility.

- New Zealand eCommerce Platform customers (Trade Me).

- Multinational tech companies like Microsoft and Google.

- Southern Link Partners/NZ Govt empowering the opportunity.

1.3. All NZ business could benefit with access to TAA:

A significant portion of New Zealand packaging is sourced offshore. Source storage kitting and export within a TAA Southern Link would reduce New Zealand exporters cost (packaging and freight) enabling further competitive advantage.

- Suppliers/Manufacturers that see the value of a 33 million market in Oceania then China and South America.

- Global retailers such as IKEA and Costco - e-tailers like AMAZON may utilize the TAA Southern Link as a New Zealand or Australasian Fulfillment hub. Enabling Kiwi exporters to access directly with global connectivity.

- The TAA Southern Link is of particular value for these global service providers because it enables critical mass/lower cost access whilst maintaining a footprint in Oceania as compared to their core markets. In turn New Zealand business have access to theses global service providers as near shore whilst in the past. The access to these service providers was difficult and expensive with long times lines of provision in the best of times.

2) Primary activities - physical supply chain:

- Inbound logistics – All the processes related to receiving, storing, and distributing inputs internally. our supplier relationships are a key factor in creating value here.

- Operations – Potential transformation activities that change inputs into outputs that are sold to customers. Our operational systems create value.

- Outbound logistics – All activities deliver product or service to put to our customer.

These 3 primary supply chain activities are crucial to Economic empowerment and Resilience.

Using 5 Porters, we look at a holistic level in terms of global supply chain performance and the impact to Aotearoa New Zealand.

Comparing the difference and the impact to the service performance requested and the crucial need of Australia within the value chain of 5 Porters.

2.1. Near Shore Just in Case v Far Shore Just in Time.

Without doubt Governments and private enterprises are embracing ‘nearshoring’, which involves producing items closer to home, this is a reversal of the decades-long trend of ‘offshoring’ manufacturing.

Bloomberg noted US CEO’s have been highlighting plans to relocate production through offshoring, reshoring or near shoring at a greater clip in 2022 than they did in the first 6 months of the pandemic.

Bloomberg links this to disruptions caused by the recent wave of strict Covid lockdowns in China triggering the decision to move production out of China.

Accelerating greater US supply chain resilience through regionalisation with the use of current USA/Canada and Mexico USCMA Agreement (Friend Shoring). The timing of these trends coincides with new pressures that businesses face.

This has been accompanied by a shift away from ‘just in time’ supply chains, which were stretched and broken during the chaos of the pandemic and further exacerbated by the recent Covid lockdowns in China.

The “just in time’ business model relies on keeping inventories of stock extremely small and ordering when demand is high, via short-term contracts, to cut costs (optimization).

For many years, it was the status quo of supply-side work. Yet in 2022, amid continuing disruptions prompted by the pandemic, companies are shifting towards a ‘just in case’ approach with production located nearer to home, and companies holding more stock in case of further disruption.

It marks a reversal of a long-standing trend where companies focused on cutting costs and reducing friction at the expense of flexibility. In this way, private enterprise and government are focusing on building resilience and responsiveness in the supply chain.

Resilience can be built into supply chains in three ways: a shift from ‘just-in-time” to “just-in-case” inventory management, the nearshoring or reshoring of manufacturing closer to the final point of retail, and an increase in transparency and monitoring to boost flexibility. Global value chain will be empowered through end-to-end integration, the development of new capabilities and tailored regional responses to the specific impact of disruptions.

In Nearshoring, Multisourcing becomes obtainable for many firms through access of a larger network of foreign suppliers and future partners within Special Economic Zones.

The use of “near shoring” and “just in case” cross border proficiency, add value to those products that public and private sectors are focused upon.

2.2. Te Aoutanga Aotearoa Southern Link

Today’s supply chains have evolved into highly complex global systems. They have multiple interdependent components and hidden vulnerabilities. They therefore need a multi-layered approach that addresses resilience over three different time horizons: short term (Operational), medium term, (Tactical) and long term (Strategic).

- The TAA Southern Link represents a like-minded special economic zone (SEZ’s) and offers an Innovative Kiwi developed framework capable of providing Customs regulatory and institutional security that may make all the difference in accelerating Regionalisation ‘

- Near shoring” and the enablement of “just in case’ to Australia and New Zealand.

- The TAA Southern Link has the ability and a clear advantage to bridge complex “multi layered vulnerabilities.”

- The TAA’s Southern Link regulatory framework means Australasian business or Govt institutions who utilise their services do not have to pay export or import duties (unless product is expedited into the New Zealand domestic economy). This could permit them to become manufacturing hubs for supply chains previously located in Asia.

- The TAA Southern Link framework may help businesses build efficiencies and thereby defray the initial costs of extricating their supply chains from importing nations like China. The TAA’s Southern Link are Innovative hubs that can catalyze supply chain relocation and mitigate Government and private business concerns.

Growing geopolitical competition with China and snarled supply chains brought on by continued government lockdowns have reinvigorated calls for “near and onshoring’. Supply chain dependency in key industries such as construction and pharmaceuticals.

- The TAA Southern Link can take hold and meet with success, it is already evident that Australia and New Zealand companies are looking to duplicate and create shorter, regionally based supply chains. The guiding theme is that regionalization is increasingly more important than globalization, therefore building future resilience and responding to shocks.

Sizeable foreign investment could be created through TAA’s Southern Link in a way that would be mutually beneficial to Australia New Zealand and Pacific Island countries.

2.3. Australia and their existing independent journey

The Australian Government has recently changed its strategic course towards increasing resilience of its economy with a set of actions focused directly on supply chains. The government provides funding through an AU$1.3 Billion to support the scaling-up of Australian businesses, transform ideas into commercial opportunities, and integrate better international supply chains. Currently the priority sectors are space, medical applications, resources, construction materials, food and beverages, defense, recycling, and clean energy. Office of Supply Chain Resilience Australia has recently created a govt department which focuses on critical supply chain vulnerabilities that could impact Australia’s national interest. This includes:

- health, safety, or wellbeing.

- economic stability and viability.

- national security.

- international partners.

This department advises the Australian Government on supply chain risks and potential actions to improve resilience. Their current work is focused on ensuring ongoing access to essential goods and services including:

- personal protective equipment (PPE).

- critical pharmaceuticals.

- agricultural chemicals.

- Semiconductors.

- telecommunications equipment.

- water treatment chemicals.

- critical plastics.

Working with industry This department engages directly with targeted sectors to help them understand Australia’s supply chain risks. These business insights can provide early warning signs of disruptions to critical supply chains.

2.4. Partnering with countries on global supply chains.

The office of Supply Chain Resilience is currently working with a number of international partners: United Kingdom They are working with the United Kingdom (UK) on a joint supply chain resilience initiative. The project provides capability building support to interested countries through shared insights and approaches. The initiative supports interested countries to:

- improve public sector approaches to building critical supply chain resilience.

- strengthen global supply chains through shared learning and coordinated action.

- build greater transparency into key global supply chains.

- promote international action to respond to disruptions.

The Global Supply Chain Resilience Forum

Australia has joined other nations to strengthen cooperation on global supply chains. The Global Supply Chain Forum is the largest multilateral forum focused on supply chain resilience This Forum is attended by ministers from the UK, Republic of Korea, Singapore, Indonesia, Japan, India, Canada, Mexico, Brazil, EU, France, Germany, Italy, Netherlands, Spain and the Democratic Republic of Congo. Addressing stresses in global supply chain and the role of governments to step in and support businesses and workers where the supply of essential goods and services is at risk of significant disruption. The Australian Government is committed to respond to important views raised by stakeholders at the Forum including the need to ensure there is adequate workforce in times of crisis, the critical role of public procurement in strengthening and diversifying supply chains, and the need for substantial public-private partnerships to build critical supply chain resilience.”

India and Japan Australia’s Minister for Trade, Tourism and Investment, Mr. Piyush Goyal, India’s Minister for Commerce and Industry, and Mr. Hagiuda Koichi, Japan’s Minister for Economy, Trade and Industry have agreed to cooperation between Australia, India and Japan to address supply chain disruptions in the Indo-Pacific region. Australia reaffirmed their commitment to further develop the Supply Chain Resilience Initiative, to promote strong, sustainable, balanced, and inclusive growth in the region. Complements Australia’s other international engagements on supply chains such as the Indo-Pacific Economic Framework and the Quadrilateral Security Forum.

. Supply Chain Resilience Funding

The Australians Government’s $15 billion National Reconstruction Fund will drive co-investments in projects that address vulnerabilities in critical supply chain while the Buy Plan Australia will ensure that the Office of Supply Chain Resilience can make use of government procurement as a major economic lever to strategically address supply chain risk.

2.5.Australia, New Zealand and Pacific Islands alignment of Supply Chain Resilience and Leverage “With Australia’s ongoing investments in building their supply chain monitoring capability. Australia are clearly leveraging their position to work with interested governments, to provide advice and support collaborative actions to strengthen key global supply chains in a way that will benefit both Australia and their partners.

Technology shifts, climate change, economic disruption, and supply chain issues are critical areas in which governments are striving for greater resilience.

- Climate-resilient government: How governments are addressing climate change.

- Reshoring and “friend shoring” supply chains: Reshaping supply chains to improve economic resilience.

- Future-proofing the lab our force: Enabling the adaptive worker of the future. Whilst Australia and New Zealand pursue independent Supply chain resilience programs.

There are no better companions to pursue mutual holistic supply chain risk mitigation and the development of competitive advantage.

Boston Consulting Group Regionalized Supply chain.

Final Note

Final note, we have used Australia's "Office of Supply Chain" as a reference in a number of occasions.

There is complexity in managing ( Governance) a supply chain initiative as what is outlined within Te Aoutanga Aotearoa Southern Link so there is value within an Office of Supply chain of some future form within Aotearoa New Zealand.

Large countries such as Australia have the capability to fully underwrite such an office.

We believe the Te Aoutanga Aotearoa Southern Link can support a Kiwi version of the "Office of Supply chain." albeit one that represents our needs at a far less cost by partnering Private and Public within a common purpose.

3) Support activities:

Whilst "Procurement" remains the action of obtaining supplies both Private and Government albeit commercial demand or essential services.

Let's focus on:

3.1. Infrastructure.

3.2. Tecnology.

3.3. Human Resource.

3.1. Infrastructure

3.1.1. What makes cities work?

What makes cities work? It is not the historic monuments or grand architecture but something far more prosaic. 360info speaks to Professor Brett Neilson from Western Sydney University.

When you travel on the outskirts of many cities, a sea of featureless warehouses can stretch to the horizon.

Behind those bland walls beats the heart of the logistical city. From Kolkata to Singapore, Hong Kong to Melbourne, the business of the modern world depends on these structures which house data centers, freight forwarders and other supply chain businesses.

How this complex system works and how it is changing the face of many post-colonial cities is a special area of interest for Professor Brett Neilson from Western Sydney University. Neilson’s research and writing aim to provide alternative ways of conceiving globalisation, with particular emphasis upon its social and cultural dimensions.

The logistical city is that part of the urban environment which is given to creating connections both in terms of transport and communication to other parts of the world.

So it can be understood as a series of infrastructures that implant themselves in urban environments in order to facilitate different kinds of flows and connections, usually with other cities, but also with rural environments.

3.1.2. Our Te Aoutanga Aotearoa Southern Link infrastructure objectives are:

- Create jobs, leading to sustainable economic growth.

- Increase social inclusion and participation.

- Enable Māori to realise aspirations in all aspects of the economy.

- Encourage environmental sustainability and help New Zealand meet climate change. commitments alongside the productive use of land, water and other resources.

- Improve resilience, particularly of critical infrastructure, and diversify our economy.

3.1.3. Te Aoutanga Aotearoa Southern Link Infrastructure needs.

There are four primary infrastructure needs:

3.1.3.1. Warehousing.

3.1.3.2. Road/Rail

3.1.3.3. Air/Sea.

3.1.3.4. Energy & Sustainability.

3.1.3.1 Warehousing

Massy University (Supply chain and logistics risk outlook 2023) note there is already a high demand on warehousing and 3PL''s, increasing cost, efficiency and potentially becoming a choke point in domestic supply chains.

However, this is not a problem that sits with Aotearoa New Zealand only? far from it.

The increase in warehousing/3PL/Manufacture- technologies/data centers over the last 25 years has accelerated to a new level of construction and associated infrastructure, is a global choke point issue.

The development of warehouse clusters in Ruakura/Auckland Airport/Te Aoutanganui CEDA and Christchurch airport (Examples) surroundings speaks for itself.

Climate change and the recent weather events plaguing Aotearoa New Zealand in 2023 to date will exacerbate the need for replacement construction and associated infrastructure.

But this is clearly only replacement of current infrastructure.

The Aoutanga Aotearoa Southern Link is focused on building the future growth of New Zealand.

Arguably there is a strong apatite to invest and build into warehousing/3PL/logistic buildings etc. The Te Aoutanga Aotearoa Southern Link will accelerate that need at a national scale with the proposed objective of foreign companies to use our country as a Southern Hemisphere hub, because of our status as a 'Special Economic Zone."

3.1.3.2. Road/Rail

The state highway network is the principal road infrastructure connecting New Zealand urban centers.

The railway network in New Zealand consists of four main lines, six secondary lines and numerous short branch lines in almost every region.

According to Global Infrastructure hub:

New Zealand has invested well below the OECD average in its core infrastructure assets over many decades.

Frequent reports of congested roads, fatigued rail tracks, water shortages and burst sewage pipes are a clear demonstration of the impact of this underinvestment.

According to the OECD economic survey of New Zealand in 2019, this has been exacerbated by the fact that local governments have borne much of the infrastructure costs with limited opportunities to recoup these costs through user charging and rates increases.

Source: Global Infrastructure Hub

Investment in road and rail infrastructure as a share of GDP

(average 2000-2010)

We must note - New Zealand is not alone in facing an Infrastructure deficit. The Global Infrastructure Hub predicts a US$18 trillion gap between the projected investment and the amount required to meet required global infrastructure needs by 2040.

In terms of the Southern Link Te Aoutanga Aotearoa, the 6 location hubs are located aside main roading and rail corridors.

This enables a crucial framework for infrastructure development.

The Southern Link Te Aoutanga Aotearoa will also be a catalyst for bringing forward longer-term government infrastructure investments such as Northland / Auckland motorway/express way extensions and the rail link to Marsden Point.

Benefits of infrastructure spending during an economic downturn

A review of 200 studies over the last 25 years by Global Infrastructure Hub concludes government investment in infrastructure is more effective than other types of public spending in increasing economic output, particularly over the medium term.

In the short term, it can boost demand and in the long-term increases both GDP and productivity.

We note the estimation of Northland roading repair due to the recent weather events in January/February 2023 will be north of $120 million.

However, we must realize this is the rebuilding of existing infrastructure that is already (in many ways) dilapidated.

The Te Aoutanga Aotearoa Southern Link is focused on the building of new road and rail infrastructure that supports the increase of GDP and productivity overall.

3.1.3.3. Shipping -Sea/Air

Each year, more than 11 billion tons of sea freight gets carried around the world by large ships. Clothes, flat-screen TVs, grain, cars, oil — transporting these goods from port to port is what makes the global economy go 'round.

Of worthy note, Aotearoa New Zealand relies significantly on airfreight for its imports and exports due to its geographical location with more than 1,600 km from our closest neighbor, Australia.

While less than 1% of New Zealand’s trade volume is carried via air, it accounts for 22% of imports and 16% of exports by dollar value.

However, due to fuel costs and the sheer distance between New Zealand’s hubs and major cities across the globe, airfreight is unsurprisingly not the primary mode of transport for cargo.

Sea freight remains the more popular option, costing ten to 20 times lesser than airfreight.

Airfreight is the preferred mode for transporting high-value cargo, perishable goods (however, technological developments have allowed such goods, to be increasingly transported by sea), and urgent documents.

The top three largest trading ports in New Zealand are topped by Auckland's seaport and the Port of Tauranga, with Auckland airport coming in at third place.

We have reasoned why the Te Aoutanga Aotearoa Southern Link "Special Economic Zone" will empower Supply chain resilience with the growth of Air and Sea volume and the subsequent relevancy for New Zealand's international trade.

Because of the nature and the value of goods (High Value) exported by air versus the volume that is exported by sea will not change at a tactical level

However, we believe the Southern Link TAA will reduce the need for future essential (emergency) services expedited by Air.

The Te Aoutanga Aotearoa Southern Link will also empower regional growth (Marsden Point/Ruakura /Te Aoutanganui CEDA /South Island) outside of the main three ports.

This will enable diversification that mitigates risk in terms of the ole phrase "don't put all your eggs in one basket".

3.1.3.4. Renewable Energy

Renewable Energy Zones are also an important tool in helping to meet the Government’s target of 100% renewable energy by 2030.

From a government perspective: “Decarbonisation is a big challenge for the energy sector.” T

The Government has clearly outlined that ‘they are proud that Northland could be a big part of the solution.”

- Marsden Point

As a national leader in "Renewable Energy through the creation of a Te Aoutanga Aotearoa Southern Link "Special Economic Zone" at Marsden Point.

Sustainable energy is derived from resources that can maintain current operations without jeopardizing the energy needs or climate of future generations.

The most popular sources of sustainable energy, including wind, solar, Geothermal hydropower and future Green Hydrogen, are also renewable.

Marsden Point has all the necessary ingredients to develop a comprehensive Renewable Energy ecosystem of supply manufacturing and supply chain support.

An important tool in helping to meet the Government’s target of 100% renewable energy by 2030. The tremendous possibility of Northlands economic growth through employment /investment and infrastructure development. The two primary Renewable Energy capability covered:

- Solar.

- Offshore wind.

Albeit alternative Renewable Energy such as onshore wind/Green Hydrogen and alternative renewable fuel will have also contribute to Marsden Points future Renewable energy aspirations.

The Te Aoutanga Aotearoa Southern Link is a catalyst of policy/technology and infrastructure with the ability to solve multi-dimensional challenges around increasing the resilience of Aotearoa New Zealand’s global supply chain into the future.

Māori, as a custodian and strategic partner of a proposed Marsden Point Special Economic Zone, would have a critical role to play as an empowerment for KIWI business and SME, by enabling access as a launch pad for new markets, help diversify supply chains and boast resilience.

We believe a Marsden Point SEZ is a unique and compelling opportunity for Aotearoa New Zealand.

To become an innovative Gateway for the Southern Hemisphere much the same way that Singapore is to Asia.

We believe The Marsden Point Special Economic Zone would be a game changer for Northland.

With the ability to become a resilient national asset of Renewable Energy supply chain infrastructure and assembly located in the center of Oceania.

- Green Transport

The Te Aoutanga AotearoaSouthern Link will abide with the Green freight project.

https://www.transport.govt.nz/area-of-interest/freight-and-logistics/green-freight/

Road freight is vital to New Zealand’s economy and is predicted to grow substantially over the next 30 years.

We see reducing GHG emissions for these types of vehicles, especially long-haul road freight, as one of the most challenging areas of transport.

The Green freight project, which was initiated in April 2019, looks specifically at the role alternative green fuels — electricity, green hydrogen and biofuels — could play in reducing emissions from heavy vehicles carrying freight on New Zealand’s roads.

The project is focused on heavy trucks involved in road freight because they account for nearly 25% of all GHG road transport emissions.

3.2. Technology

The Te Aoutanga Southern link will undertake innovative transformative technology.

There will be three strategies.

3.2.1. eCommerce Strategy

Capitalise fully on our competitive advantages in a networked world.

- Innovate:

Support enterprise by providing an environment that rewards innovation and entrepreneurship.

- Skill:

Foster the highest quality e-commerce skills to build innovation, technical and management capability.

- Economic:

Provide an environment that supports ICT infrastructure development, business performance and increased economic well-being for individuals.

3.2.2. Cyber Security Strategy

Balance risk with being agile and adaptive Outcomes:

- The TAA Southern Link will use our collective strengths to deliver better results and outcomes Accountable.

- will be open and accountable.

- Aligned with Government needs.

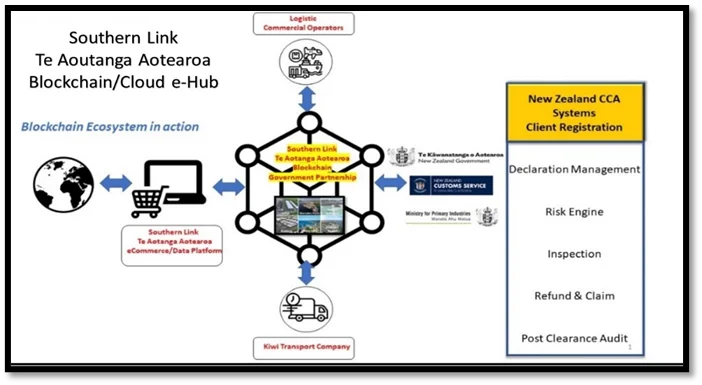

3.2.3 Blockchain Cloud

Our entire Blockchain/Cloud ecosystem is based on ensuring Aotearoa New Zealand remains one-step ahead.

We want to lead in digital, as well as physical infrastructure, and to achieve that we need to co-create with our Southern Link partners, commercial service providers, customers, Government and become a globally connected Trade Hub.

The TAA Southern Link focus on innovation puts us in an ideal position to be able to collaborate and facilitate across the global supply chain.

Aotearoa New Zealand’s Potential and the Opportunity Enhanced security.

3.2.3.1. Data breaches:

Cyber Crime and fraudulent transactions are major concerns for ecommerce retailers. According to Price Water house Coopers annual Global Economic Crime and Fraud Survey 2020, 47% of companies experienced fraud in the past 24 months with a total of $42 billion lost. Blockchain technology allows for trusted identities verified by multiple trusted parties, and offers the highest level of security for customer databases and CRM systems.

3.2.3.2. Cost savings.

Significant advantage of blockchain technology is that it allows retailers to combine services like payment processing, inventory management, product descriptions, etc. so that they spend less on buying and maintaining separate systems.

3.2.3.3. Easier, faster transactions.

Blockchain transactions are basically instantaneous and do not go through traditional banks, there are no delays for payment processing or pending transactions. Purchases can be made instantly, which means faster order fulfilment for customers.

3.2.3.4. Improved business processes.

Blockchains can store more than just transactional data. They can store smart contracts which can automate tasks based on pre-set rules and if-then statements, like automatic payments or inventory management. Cloud.

3.2.3.5. Cloud blockchain

Enhances cloud security, through encryption and hashing and prevents data tampering. Additionally, blockchain on the cloud offers faster data management because, with cloud blockchain architecture, there are several copies of the same data stored on multiple computer nodes.

3.3 Human Resources

Massy Universities “New Zealand Supply Chain and Logistics Risks for 2023’

Outlined the following "Staffing' review:

Increasing job pressures was the most frequently mentioned issue when supply chain practitioners were asked about their work in 2023.

There is still a significant labour shortage that impacts on all parts of the supply chain, including ports, warehousing, transport, casual labourers, but also specialist skilled personnel. Inflation is driving high r salary expectations and, following on from SCRAN's mid- year outlook, disruptions caused by labour strikes remain a high likelihood into 2023.

Staff turnover is expected to remain high into 2023, increasing the time spent recruiting. Under a slowing economy, the likelihood of staff restructuring remains high.

Many businesses are re-aligning their strategies, renegotiating with supply chain partners and implementing improved systems, which places additional strain on staff and broadening the complexity of their work. These issues are likely to impact the responsiveness of supply chain partners in 2023.

This is not just a New Zealand centric Human resource concern, in terms of labour shortage. Australia/UK/USA/and Canada are having the same issues.

Human Resource can be defined as a group that has responsibility for managing the life cycle of the employees.

This will need a holistic national sphere of influence, understanding and control across a complex labyrinth of expertise including labour shortages.

We live in an extremely competitive world in attracting quality expertise.

Here the Governments role is to clearly act as the principal conduit.

Promoting and attracting the caliber of labour that is needed to staff the myriad of new companies that will be attracted to the Te Aoutanga Aotearoa Southern Link through the advance of New Zealand's "Special Economic Zone."

Example Text