FREEPORTS

UK Government policy on freeports is a "Top Down" initiative.

https://commonslibrary.parliament.uk/research-briefings/cbp-8823/

A 2018 report suggested that freeports could create 150,000 new jobs while boosting trade by £12 bn per year and UK GDP by £9 bn. The 2019 Conservative Party Manifesto included a commitment to create up to ten freeports around the UK. According to the Government, freeports are intended to be:

- National hubs for global trade and investment across the UK.

- They aim to promote regeneration and job creation as part of the Government’s policy to level up communities.

putting communities on the path to long-term growth and prosperity.

- In addition, the Government sees them as hotbeds for innovation.

What is a Free Port

A freeport is a designated geographical area which can benefit from concessions on customs, taxation, and planning advantages, and from reduced bureaucracy. Goods can enter freeports without paying tariffs. Manufacturing businesses operating in the freeport area can use the imported goods to create new products which are then exported without ever having to pay the full tariff on the imported goods.

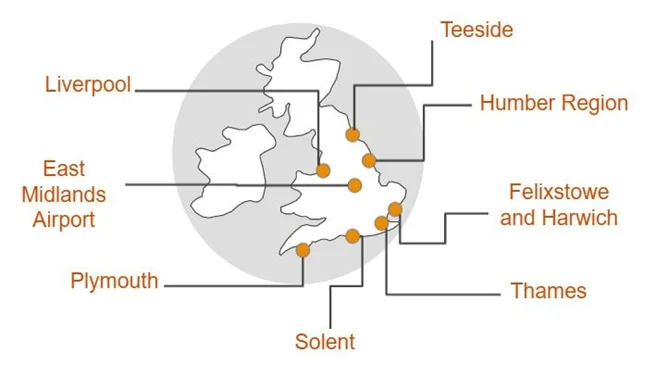

The March 2021 Budget announced eight freeports in England:

The UK Government’s intention to re-establish free ports in the UK culminated in the announcement in March 2021. With the creation of 8 Free Ports within the UK. The UK Government also hopes that at least one freeport will be established in each of:

- Northern Ireland,

- Scotland, and Wales.

- East Midlands Airport.

- Felixstowe & Harwich.

- Humber.

- Liverpool City Region.

- Plymouth & South Devon.

- Solent.

- Teesside.

- Thames.

Other tax incentives to freeport businesses include enhanced capital allowances, relief from stamp duty and from employer national insurance contributions for additional employees. Grant funding for regeneration and infrastructure will also be available.

Freeports benefit from incentives relating to customs, tax, planning, regeneration, infrastructure and innovation. English freeports which have been given final government approval will each receive up to £25 million in seed funding plus significant sums in locally retained business rates Businesses operating in free zones are offered the following benefits.

- Simplified customs procedure.

- Relief on customs duties relating to transhipment, handling and processing of goods destined for re-export.

- Cash-flow benefits of duty deferral until goods are released for free circulation in the domestic economy (or used or consumed within the free zone).

- Added security from the perimeter fence enclosing the free zone.

- Tariff inversion: some finished goods incur lower tariffs than intermediate goods; this means that intermediate goods can be imported to free zone tariff-free, processed and sold as a final product, incurring lower tariff rates.

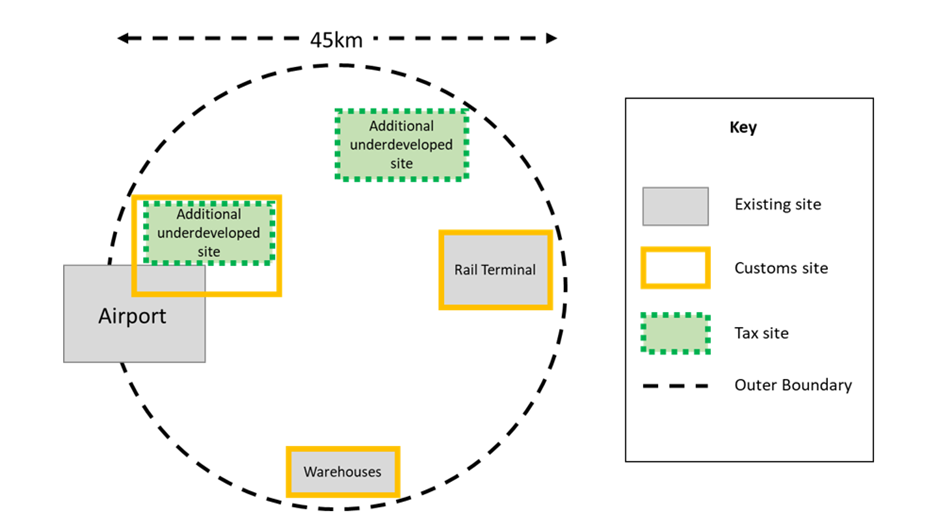

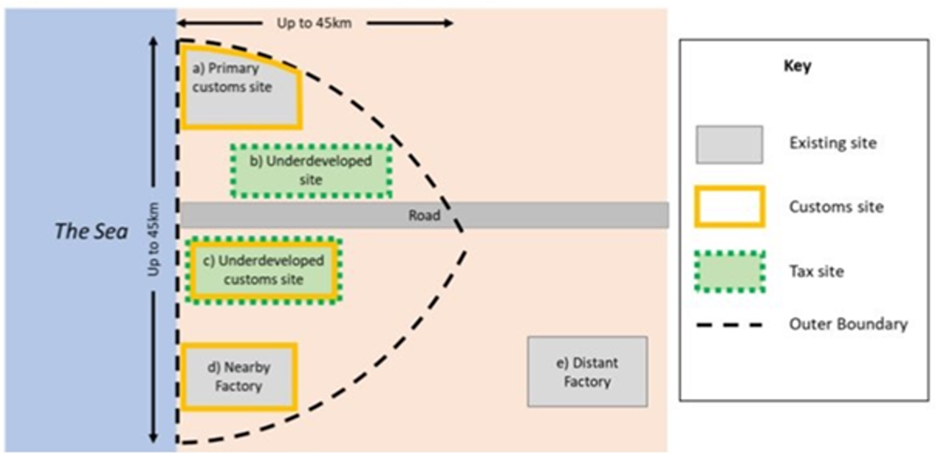

The image illustrates examples of a Freeport centred around a seaport and airport.

Freeport customs sites meeting the criteria can be designated at any location within the wider Freeport boundary.

Although part of an existing port may be designated as a Freeport customs site, it is not a requirement to do so.

Both existing premises and greenfield/brownfield sites are eligible for designation.

Free zones in the EU and globally

Within the EU, there are currently 80 free zones located across 21 EU Member States, according to a list for the EU Member States provided by the Directorate-General for Taxation and Customs Union (DG TAXUD).

These pertain to ‘control type I free zones’, which are an enclosed geographical area (with a perimeter fence) instead of a building or premises, and where goods placed within the area are checked by the customs authorities upon entry and exit.

In the EU, there also used to be ‘control type II free zones’ – where physical control of goods placed within the zone was done based on stocktaking (rather than at entry and exit points to the zone) and additional physical inspections. But as of 1 May 2016, these were re-classified as customs warehouses due to the application of the Modernised Customs Code in the EU (see Article 288(2) of the Union Customs Code). More than 4,300 Special Economic Zones (of which free zones are one type) may be in operation around the world.

The Free Zones (Customs, Excise and VAT) Regulations 2021

ttps://www.gov.uk/government/publications/the-free-zones-customs-excise-and-vat-regulations-2021/the-free-zones-customs-excise-and-vat-regulations-2021 Policy Paper

Who is likely to be affected?

Businesses trading in or moving goods to or from the United Kingdom (UK) that wish to store or process goods in a free zone, and authorities responsible for operating free zones.

General description of the measure

This measure sets out the Customs Duty, excise duty and VAT rules that will apply for UK free zones. Free zones are secure customs zones located within a Freeport where business can be carried out inside the UK’s land border, but where different customs, VAT and excise rules apply. Freeports can reduce administrative burdens, provide duty and import tax advantages, ease tax and planning regulations, and support regeneration.

Policy objective

To establish the rules for the operation of a free zone procedure within Freeport locations so that businesses may benefit from the Freeports customs offer. Freeports are intended to support the policy of levelling up the towns, cities and regions of the UK.

Background to the measure

The Government included a commitment in its 2019 manifesto to create up to 10 Freeports around the UK. On 10 February 2020 the Government published a consultation on Freeport policy in respect of its plans to introduce Freeports. This included setting out the Freeport customs offer, which enables businesses to benefit from duty suspension arrangements and simplified customs procedures.

The customs offer was generally received positively, and a consultation response was published on 7 October 2020. This was followed by a Freeport bidding prospectus on 16 November 2020, setting out the customs model in more detail, allowing businesses to submit their version of a Freeport.

The 2021 Spring Budget announced the locations of 8 Freeports in England: East Midlands Airport Felixstowe and Harwich Humber Liverpool City Region Plymouth and South Devon Solent Teesside Thames These are expected to start operating from Autumn 2021, subject to the successful completion of their business case assessments.

Current law

Section 100A of the Customs and Excise Management Act 1979 (CEMA) provides that HM Treasury may, by order, designate any area in the UK as a special area for customs purposes (a free zone).

There are currently no free zones operating within the UK. The Taxation (Cross-border Trade) Act 2018 (TCTA): makes provision for chargeable goods kept in a designated free zone to be declared for a customs storage procedure (referred to in this note as ‘a free zone procedure’) provides for the Customs Duty position of goods declared to this customs procedure (including the general rule at section 4(2)

TCTA that a liability to import duty is not incurred by reference to the importation of chargeable goods declared for a free zone procedure) includes powers allowing regulations to be made by HMRC Commissioners imposing requirements on any person in relation to these customs procedure However, because there are currently no free zones operating in the UK the above TCTA provisions and powers have not been applied or used to date in relation to the free zone procedure.

The excise provisions are set out in sections 45(1) and (2) and 48(10) and (11) of TCTA. Current VAT law is contained in: Schedule 8 to the Value Added Tax Act 1994 (VATA) (zero-rating) Regulation 14 (contents of VAT invoice) of Part III of the Value Added Tax Regulations 1995 (SI 1995/2518) Regulation 27 of the Free Zone Regulations 1984 (SI 1984/1177)

Proposed revisions.

In relation to Customs Duty, the measure includes regulations concerning the general operation of free zones and the free zone procedure as well as requirements that apply to any goods kept within a free zone customs site (regardless of whether those goods are declared for a free zone procedure).

These rules will operate alongside the conditions and requirements imposed upon a ‘responsible authority’ for each free zone in the HM Treasury Order designating the free zone (made under section 100A CEMA), and the rules concerning import duty and customs procedures set out in, and under, TCTA.

The Customs (Special Procedures and Outward Processing) (EU Exit) Regulations 2018 (SI 2018/1249) are being amended to include provisions concerning: the goods which can be brought into a free zone or declared to a free zone procedure.

Authorisation rules for any person wishing to carry out processing and other activities in relation to goods that have been declared to a free zone procedure. a requirement that certain activities that take place in a free zone, or the arrival of certain goods in a free zone, must be notified to HMRC.

The exit of goods from a free zone, including a requirement to notify a responsible authority for the free zone that goods are to leave the free zone.

The measure also includes various provisions concerning compliance and control of goods in a free zone – including requirements placed on a responsible authority in relation to breaches of the customs rules in a free zone – a power for HMRC to impose additional requirements upon a responsible authority – an ability for HMRC to restrict or prohibit activities within a free zone or require production of goods for examination – as well as record-keeping requirements for responsible authorities and persons carrying on activities within a free zone.

The measure includes provisions concerning the declaration of goods for a free zone procedure. This includes, for example, amendments to the Customs (Import Duty) (EU Exit) Regulations 2018 (SI 2018/1248) to allow certain goods to be declared to the free zone procedure by conduct where free zone and business records are updated to record the receipt of goods in the free zone.

Cases in which such a ‘by conduct’ declaration cannot be made will be set out in a reference document “Cases where goods cannot be declared by conduct or are not treated as declared for a free zone procedure on discharge of a transit procedure in a free zone”.

The measure also includes provisions concerning the calculation of Customs Duty due if goods that were subject to a free zone procedure are subsequently declared to free circulation. Amendments are also made to other customs legislation in order to accommodate free zones and goods placed under the free zone procedure.

These include changes to the: Customs Transit Procedures (EU Exit) Regulations 2018 (SI 2018/1258) to provide for cases in which goods end a transit movement in a free zone and are subsequently placed under the free zone procedure. Customs (Contravention of a Relevant Rule)

Regulations 2003 (SI 2003/3113) in order to make provision for penalties to be charged in cases where there is a breach of customs requirements in relation to free zones.

Customs (Export) (EU Exit) Regulations 2019 (SI 2019/108) to set out rules that apply when goods declared for the free zone procedure are exported from the UK.

In relation to VAT, the measure inserts a new group into schedule 8 to VATA, to provide a zero rate for specified supplies of goods and services in a free zone where certain conditions are met.

The measure also amends regulation 14 of the Value Added Tax Regulations 1995, to provide for additional information to be included in invoices where such supplies are made, and revokes regulation 27 of the Free Zone Regulations 1984 (SI 1984/1177), which is obsolete.

In respect of excise goods, this includes provisions to make sure the effective customs control of the goods.

This includes the specific authorisation of excise businesses enabling obligations to be imposed in relation to holding or producing excise goods.

Amendments are also made to excise legislation to accommodate free zones including changes to the Excise Goods (Holding, Movement and Duty Point) Regulations 2010 (SI 2010/593).

Summary of impacts Exchequer impact (£million)

Costings, where required, will be subject to scrutiny by the Office for Budget Responsibility and included in their forecasts at a future fiscal event.

Economic impact.

This measure is not expected to have any significant macroeconomic impacts.

Impact on individuals, households, and families.

There is expected to be no direct impact on individuals, households, and families, as the measure introduces optional arrangements which are expected to be of interest only to businesses that wish to use free zones. The measure is not expected to impact on family formation, stability or breakdown.

Equalities impacts.

It is not anticipated that there will be impacts on groups sharing protected characteristics.

Impact on business including civil society organisations.

The impact for business is that this measure provides for an optional alternative to other customs procedures, by providing additional benefits not otherwise available, such as simplified declarations and streamlined customs procedures.

It will be a commercial decision for businesses as to whether they wish to take advantage of these arrangements.

They will need to familiarise themselves with the rules in relation to free zones and the operation of free zone procedures and decide if the benefits outweigh any costs.

Businesses that opt to do so may also incur one-off costs for IT system changes, meeting authorisation requirements and staff training.

Continuing costs for businesses will include record keeping, making sure compliance with the rules, and making goods available to HMRC for examination. There is expected to be no impact on civil society organisations.

Operational impact (£million) (HMRC or other)

There will be a requirement for HMRC’s Customer Compliance Group (CCG) to make sure that businesses operating and using free zones comply with the relevant rules. Additional resources will be required to support this work.

The CCG additional resource requirement bids for each year from 2021 to 2022 to 2025 to 2026, together with the redeployment of existing resources from other areas of work (such as EU exit), are expected to provide the compliance resource for this work.

Other impacts

Other impacts have been considered and none have been identified.

Monitoring and evaluation

The measure will be monitored through information collected as part of the authorisations process and from declarations, as well as through communications with the affected taxpayer population. The Customs Site Operator will also monitor business activity in each site.